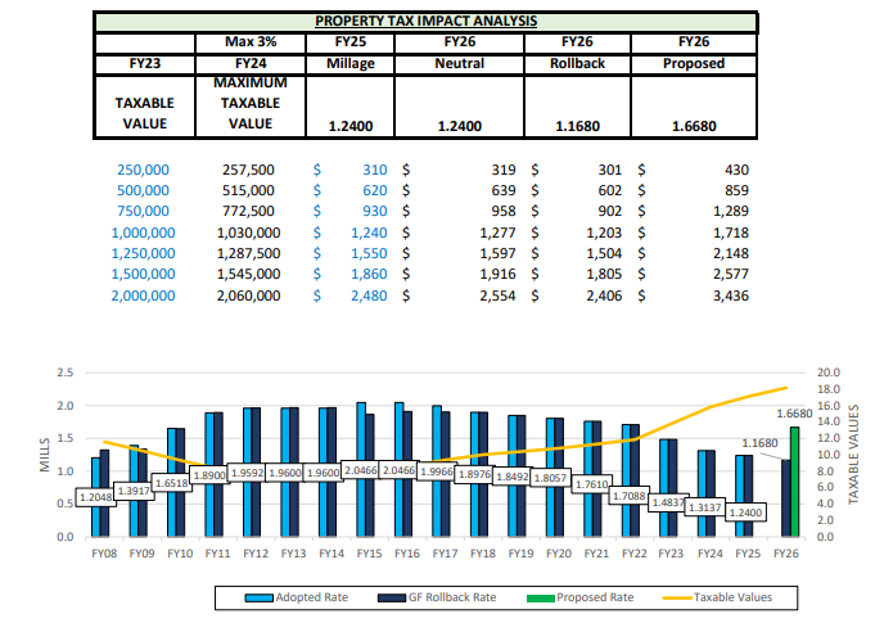

On July 21, 2025 the Marco Island City Council held a budget workshop to review the City’s proposed operating budget for Fiscal Year 2026 which begins October 1, 2025. Subsequently at the regularly scheduled City Council meeting the same day, the Council approved a tentative General Fund millage rate of 1.6680 to fund the proposed 2026 budget. If adopted, this millage rate would represent a 33.9% increase over the prior year General Fund millage rate of 1.2400. Even given that, 1.6680 mills represents the fourth lowest millage rate for the City of Marco Island in the last fifteen years.

During three budget workshops City Council led a careful analysis of deferred maintenance, deficiencies in median landscaping, infrastructure requirements of roads and bridges, and then set priorities to restore proper funding for these critical projects. They also identified the need to rebuild emergency reserves as a hedge against future weather events. In order to provide for these needs, a 1.6680 millage rate was proposed. With this new revenue, $4.5 million will be dedicated to road resurfacing, swale maintenance, bridge rehabilitation, parks capital projects, and median landscaping. Additional revenue will fund the City’s capital asset replacement plan, parks maintenance, a wage adjustment to bring City employees to market rate wages, and an additional one million dollars dedicated to the City’s emergency reserves.

The last time the City of Marco Island residents experienced a property tax increase was in 2016 when the millage was approved at 2.0466 mills. Millage refers to the tax rate that is assessed for each $1,000 of property value. In other words, one “mill” is equivalent to one dollar per $1,000 of assessed value. Since 2016, the millage has been decreased every year to the current rate which is 1.2400 mills, one of the lowest in the entire State of Florida. While this millage increase is a substantial tax increase over the current year, the property tax rate is significantly less than it was fifteen years ago (1.8900 mills). If the 1.6680 millage rate is adopted, homeowners whose property’s taxable value is $1 million will see a $441 increase in their annual tax bill ($37 per month). Owners whose property’s taxable value is $500,000 will see an increase of $239 in their annual tax bill ($20 per month). Seventy-five percent of Marco Island properties are assessed at less than $1 million, and Marco Island property taxes represent approximately 13% of a homeowner’s total tax bill. Even at the proposed millage rate, Marco Island taxpayers will continue to pay more in taxes to Collier County General Fund and the State and local school boards, than they pay to the City of Marco Island. Nevertheless, this is still a new and substantive increase, and it’s important that residents understand how their tax dollars are being spent.

Residents are encouraged to watch the City Council budget workshops dated May 19, June 16, and July 21, 2025 at this website: Budget Meetings. The City Council will meet on August 4th and 18th in the Community Room at 51 Bald Eagle Drive and public comment is open at 6:00pm for anyone who wishes to comment on the fiscal year 2026 proposed budget. The proposed millage is a tentative millage rate until the final budget hearing which will be held at 5:30pm on September 2, 2025 in the Community Room. Specific questions can also be directed to the City Manager or Assistant City Manager by calling 239-389-3969. If you would like to have a speaker on this topic for a group of residents or civic association, please contact Assistant City Manager, Casey Lucius.