Preliminary Flood Insurance Rate Maps (FIRMs)

Residents and property owners in coastal areas of Collier County and all of Marco Island can view new draft preliminary Flood Insurance Rate Maps (FIRMs). https://fema.maps.arcgis.com/apps/webappviewer/index.html?id=e7a7dc3ebd7f4ad39bb8e485bb64ce44 - PDF Directions below.

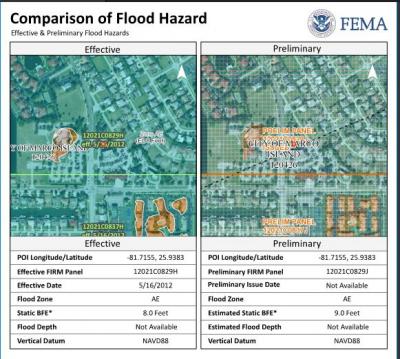

The new preliminary FIRMs were developed through a partnership between the communities and the Federal Emergency Management Agency (FEMA). They are based on updated modeling data and show coastal flood hazards more accurately than previous maps.

The Island’s current FIRM is dated May 16, 2012. FIRMs show the potential extent and risks of flooding. These FIRMs are used to help determine flood insurance premiums and construction requirements. FIRMs are also used by contractors, insurance agents, realtors, surveyors, engineers, and community planners to obtain the most current flood risk information on a property-by-property basis.

The updated FIRMs are still preliminary and have not yet been officially adopted. This page will be update accordingly when more dates and information become available. Should you have any questiosn please contact the City's Floodplain Coordinator

Kelli DeFedericis, CFM, kdefedericis@cityofmarcoisland.com , 239-389-3926

City of Marco Island has a Community Rating System (CRS) class rating of 6 .CRS class rating 6 gives a 20% discount off the flood insurance premium. As of April 2019, there are 259 Florida communities participating in the CRS program.

There is a total of 6,166 flood insurance policies on the island. 6,060 policies are located within the SFHA. 72 policies are located outside of the SFHA.

Combined total of $9,917,081 in policy premiums.

Average premium $615.

Average CRS savings per premium $204.

Combined total CRS savings $3,295,280.

Marco Island holds spot 25 in the state of Florida for policy count. Miami Dade being number one and Collier County being number two.

Parks & Recreation Facebook MIPD Facebook

Fire Rescue Twitter

Parks & Recreation Twitter

Marco Island Police Twitter